Case Study:

Inventory Optimization

Initial Situation

- Significant inventory buildup due to pandemic-related safety concerns and long lead times

- Inventory levels increased drastically in value

- High „Months of Supply“ for multiple vendors

- Low inventory turnover in many product groups

- Increased risk of aging stock, write-downs, and cash flow impact

Actions & Approach

Structured Inventory Optimization Approach

1. Inventory Transparency

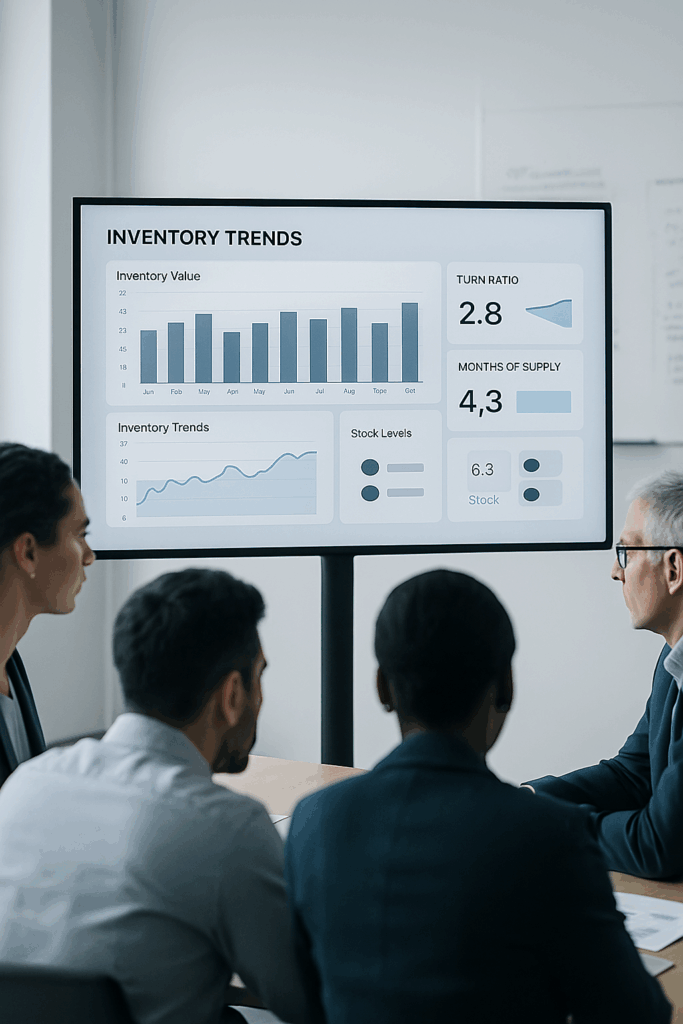

Weekly dashboard with all relevant KPIs:

Inventory Total / Projected Inventory Trends / Months of Supply / Turn Ratios / Overdue Backlog

- Vendor-specific analysis & urgency classification

2. Targeted Inventory Actions

- Prioritized measures for the tier 1 manufacturers

- Initiated inventory promotions, vendor returns and customized reallocations

3. Cross-Functional Collaboration

- Coordination with Sales, Finance & Demand teams on push/pull scenarios

- Integrated financial criticalities (e.g. Shipment Blocks)

- Analyzed backlog risks & initiated reallocations for at-risk inventory

4. Structured Decision Reviews

- Weekly performance reviews at SKU/vendor level

- Early warning system for aging stock

- Included risk backlog in action planning

Results & Impact

- Significant inventory reduction with Tier1 suppliers within 3 months

- Reduced inventory reach

- Improved turn ratio in strategic product groups

- Avoided write-downs on excess inventory

- Improved transparency for management decisions and controlling